Armaan Capital Real Estate: Turning Dreams into Disciplined Investments

Real estate markets are filled with shifting sands, where prices rise

and fall with little warning, regulations evolve constantly, and property types

multiply across the spectrum. For investors, this environment can feel like

stepping into a maze where every turn holds both opportunity and risk. Making

the right decisions requires more than instinct; it demands clarity, insight,

and guidance that turns uncertainty into strategic advantage.

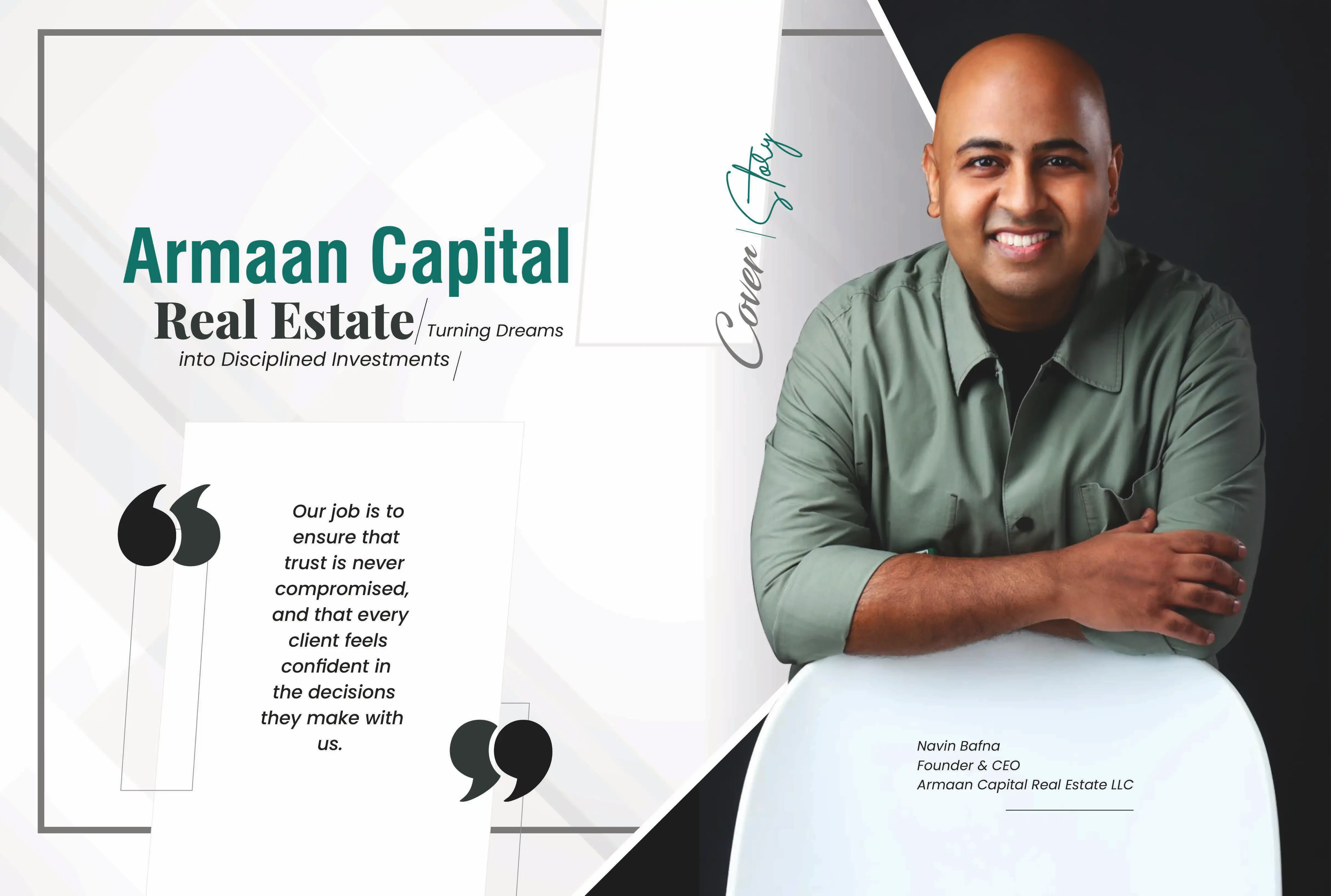

Amid this intricate market, Armaan Capital Real Estate has emerged as a name synonymous with precision and trust. The firm elevates real estate advisory beyond transactions by blending rigorous research, global market knowledge, and personalized client strategies.

Building a Philosophy of Trust and Discipline

The founding of Armaan Capital Real Estate was driven by a vision that

went beyond establishing a brokerage. It was about creating a philosophy rooted

in trust, research, and long-term relationships. Navin Bafna, Founder and CEO,

transitioned from banking and corporate finance into real estate, gaining

extensive experience in Singapore’s highly efficient and transparent market.

There, he observed how discipline, data-driven analysis, and structured

investment strategies defined success. Inspired by these principles, he

envisioned bringing a similar approach to Dubai, a city known for its rapid

growth and dynamic real estate market.

Armaan Capital was founded with clear objectives. The firm aimed to

introduce Singapore-style discipline and research-driven investment models to

Dubai, provide clarity to clients in a market that can often seem opaque, and

build a trusted brand that treats each transaction as part of a long-term

journey of wealth creation. The company’s name, Armaan, which means desire,

reflects this vision of fulfilling the aspirations of clients, investors, and

families by generating lasting value through real estate.

Research-First Approach and Strategic Differentiation

Armaan Capital sets itself apart from other real estate brokerage firms

in Dubai and Southeast Asia by focusing on problem-solving rather than purely

on property sales. The organization follows a research-first approach, treating

real estate like an investment bank treats capital markets. Every

recommendation is supported by detailed financial modeling, rental yield

analysis, internal rate of return calculations, and macroeconomic research.

Unlike typical brokers who highlight locations or luxury, Armaan Capital

quantifies value.

The firm also leverages cross-market knowledge, benchmarking Dubai

opportunities against global standards. Navin Bafna’s experience in Singapore

and Southeast Asia enables the team to guide clients who have investments in

major markets such as London, Singapore, and Hong Kong. This global perspective

allows clients to evaluate Dubai in terms of yield, risk, and capital flows,

instilling confidence in their investment decisions.

Integrity is central to Armaan Capital’s business model. The

organization prioritizes reputation over volume, consistently placing client

trust above short-term gains. By adhering to principles of transparency and

honesty, Armaan Capital functions not just as a brokerage but as a strategic

advisor to family offices, high net-worth individuals, and institutional

investors.

Maintaining Excellence Through Integrity

Integrity at Armaan Capital is more than a guiding principle; it is the

foundation of the firm’s operations. Every transaction is approached with the

understanding that it represents someone’s life savings, portfolio, or

long-term aspiration. This responsibility motivates the team to uphold the

highest standards of excellence.

The firm’s commitment is reinforced by the trust clients place in them,

the pride and ambition of the team members, and the long-term vision for Armaan

Capital to endure as a respected institution. By maintaining these standards,

the company ensures that its reputation for integrity and strategic insight

continues to grow, securing lasting relationships and multi-generational client

loyalty.

.jpg)

Building Trust Through Every Detail

At Armaan Capital Real Estate, client relationships are built on

transparency, communication, and long-term engagement. The firm ensures trust

is maintained throughout the property transaction process by sharing every cost

upfront, from DLD fees to VAT and renovation budgets, leaving no room for

surprises. Regular updates keep clients informed at every step, eliminating

uncertainty or delays. The commitment extends beyond the handover, with ongoing

support in areas such as rental management, refinancing, and resale strategies.

By consistently prioritizing the client’s perspective, Armaan Capital positions

itself as a partner on the client’s side of the table rather than merely a

facilitator of sales.

Overcoming Hurdles in a Competitive Market

Dubai’s real estate market offers immense opportunities but presents unique challenges due to rapid changes in regulations, intense competition, and market speculation. Armaan Capital has addressed these challenges by emphasizing research, transparency, and client-focused guidance. One significant obstacle was educating investors accustomed to quick flips, showing through case studies and data that long-term Grade-A assets and income-producing properties could often outperform speculative investments. Another challenge involved managing cash flow discipline, helping clients avoid overleveraging despite flexible payment plans prevalent in Dubai. By adhering to its core values, the firm has distinguished itself as a trusted advisor in a crowded and fast-moving market.

Benchmarking Dubai

to the World

Armaan Capital draws on its expertise across both the UAE and Southeast

Asia to provide clients with a competitive edge. Founder and CEO Navin Bafna’s

experience in Singapore allows the firm to benchmark Dubai opportunities

against global standards in terms of yield, regulations, and liquidity.

For instance, Grade-A office properties in Dubai may yield 9 to 11 percent compared to 3 to 4 percent in Singapore, while entry barriers and liquidity dynamics differ between the markets. By presenting Dubai as part of a broader, global investment strategy rather than in isolation, Armaan Capital enables clients to view the market as a calculated opportunity within their diversified portfolios. This international perspective ensures clients make informed decisions and approach real estate investment with clarity and confidence.

Technology as a Strategic Partner

At Armaan Capital Real Estate, technology plays a critical role in

enhancing operations and client services. The firm leverages advanced tools for

market research, providing real-time access to transaction data, rental yields,

and global investment flows. Digital platforms facilitate seamless client

communication through instant reporting, digital brochures, and WhatsApp

updates. Operational efficiency is another focus, with every process documented

and tracked digitally, reflecting the discipline and precision inspired by

Singapore’s market practices. Despite the heavy reliance on technology, Armaan

Capital emphasizes the combination of data with human judgment, ensuring

clients benefit not only from information but also from strategic insight and

experience.

Tailored for Every

Story

Armaan Capital tailors its services to meet the unique needs of each client. Recognizing that every client has a distinct story, ranging from first-time buyers seeking stability to high-net-worth individuals pursuing trophy assets, the firm emphasizes deep listening and understanding. The team assesses each client’s risk appetite, customizes investment structures including offshore companies, free zones, or mortgage solutions, and adapts communication styles and reporting to suit diverse backgrounds, whether family offices in Singapore or entrepreneurs in Dubai. For Armaan Capital, real estate is not just about properties; it is fundamentally about people and creating solutions that align with individual goals.

Dubai’s Next

Investment Wave

Looking ahead, Armaan Capital anticipates three major trends shaping Dubai’s real estate market over the next five to ten years. First, the institutionalization of real estate, with the growth of REITs and structured capital, is expected to bring greater stability and price appreciation. Second, a commercial real estate renaissance will occur as global companies expand into Dubai, driving demand for Grade-A office spaces similar to Singapore’s central business district transformation. Third, wealth migration from regions with changing tax policies will continue to attract affluent families seeking research-driven, globally benchmarked advice. Armaan Capital is positioning itself as the bridge between institutional rigor and Dubai’s entrepreneurial energy, ensuring clients are well-prepared to navigate and capitalize on these emerging trends.

Fostering a Culture of Continuous Learning

Armaan Capital Real Estate treats its office environment as a hub for learning and professional growth. The firm conducts weekly knowledge sessions covering market updates, case studies, and global comparisons. Mentorship is a cornerstone of the organization, with the Founder and CEO, Navin Bafna, personally guiding team members not only on sales but on developing the mindset of trusted advisors. Curiosity is actively encouraged, with the team taught to understand why each opportunity matters rather than merely what to sell. In a fast-moving market like Dubai, Armaan Capital views continuous improvement as essential for maintaining competitiveness and sustaining success.

Crafting

Confidence Through Strategy

Armaan Capital has a proven track record of helping clients achieve significant real estate outcomes. A notable example involves a family office diversifying investments from Singapore into Dubai. Initially skeptical due to perceptions of Dubai’s speculative market, the client was guided through detailed comparative models of yields in Singapore, London, and Dubai. Based on Armaan Capital’s disciplined recommendations, the family office invested in a portfolio of Grade-A office properties. Two years later, the client not only achieved 9–10 percent net yields but also enjoyed capital appreciation beyond expectations. This success highlighted Armaan Capital’s ability to turn skepticism into confidence by demonstrating that disciplined investment strategies in Dubai can outperform traditional markets.

Building a Legacy

of Global Excellence

Armaan Capital’s long-term vision extends beyond being a traditional brokerage. The firm aims to build a platform that stands alongside the world’s most respected real estate advisors. Over the next decade, plans include institutionalizing its model to provide global investors access to Dubai real estate with the same level of trust found in markets like Singapore and London, expanding geographically to Singapore, London, and Abu Dhabi, and establishing a lasting legacy in the real estate advisory sector. By merging Singapore’s disciplined investment approach with Dubai’s dynamic market, Armaan Capital seeks to create a company that reflects the best of both worlds while elevating the standards of real estate advisory in the region.

Also Read Businesss Media Minds For More Information